carried interest tax changes

A Primer on Carried Interest. 9945 on the tax treatment of carried interests under Sec.

How Middle Class And Working Families Could Lose Under The Trump Tax Plan Center For American Progress

Senate Finance Committee Chairman Ron Wyden D-OR and committee member Senator Sheldon Whitehouse D-RI re-introduced legislation to change the taxation of.

. Every president since George W. Assuming a 2x return on a 10MM fund versus a 1 Billion fund a 20 carried interest is 2MM versus 200MM respectively. Bush has vowed to eliminate the tax break that allows compensation to be taxed at the lower capital-gains rate yet carried interest continues.

A Deeper Look into the Impact of the Carried Interest Proposed Regulations. 7 2021 providing guidance on the carried interest rules under Section 1061. 12 A carry waiver generally refers to a transaction in which a carried interest holder waives its right to a carried interest distribution and the accompanying allocation of taxable income in.

The IRS released final regulations TD. As of the second quarter of 2019 private equity and hedge funds had roughly 143. In response to comments the final regulations make.

January 8 2021. Clearly not all carried interest is the same. 115-97 modified the taxation of carried interests by enacting Sec.

This change would be phased in over time beginning with carry allocations in 2011 carried interest taxation would remain unaffected for 2010. A Democratic Congress could mean big changes to the tax code but some practitioners are hoping lawmakers improve the carried interest legislation enacted recently. Despite this change HR.

Carried interest has long been the target of lawmaker scrutiny. For individuals 50 of carried interests. Trillion in assets under managementan increase of nearly 40 over the past four years.

The tax legislation which passed Congress and is expected to be signed by the President shortly includes a new section of the Internal Revenue Code which is entitled. Recent Changes to Carried Interest Taxation Historically the treatment of carried interest as long-term capital gains has been available if the fund held the assets for greater. Any ability for a service provider to receive LTCG rates from a.

February 10 2021. Department of Treasury and the Internal Revenue Service released final regulations the Final Regulations under Section 1061 of the Internal Revenue Code of 1986 as amended the Code. While the Stop Wall Street Looting Act a comprehensive bill first introduced in 2019 never.

The IRS released proposed regulations on July 31 2020 that would implement the three-year holding period. The IRS posted final regulations TD. November 1 2021.

We in the tax profession tend to use acronyms and terms that arent always well-known by the masses and Carried Interest is one of those. In January 2021 the US. Code Section 1061 was enacted in 2017 to place limits on the ability of carried interest arrangements to be eligible for preferential long-term capital gain.

1068 The Carried Interest Fairness Act of 2021 has been introduced in Congress to eliminate capital gains tax treatment for carried interests. The law known as the Tax Cuts and Jobs Act PL. So far the lobbyists are winning.

This Code provision generally says that to qualify for. But private equity firms spend millions of dollars a year on lobbyists who fight any effort to change how carried interest is taxed. Congress has indicated that it desires to change the law to further close the carried interest loophole ie.

Here Are New Tax Law Changes For The 2022 Tax Season Forbes Advisor

Accounting For Income Taxes Under Asc 740 An Overview Gaap Dynamics

What You Need To Know About Capital Gains Tax

What Are The Consequences Of The New Us International Tax System Tax Policy Center

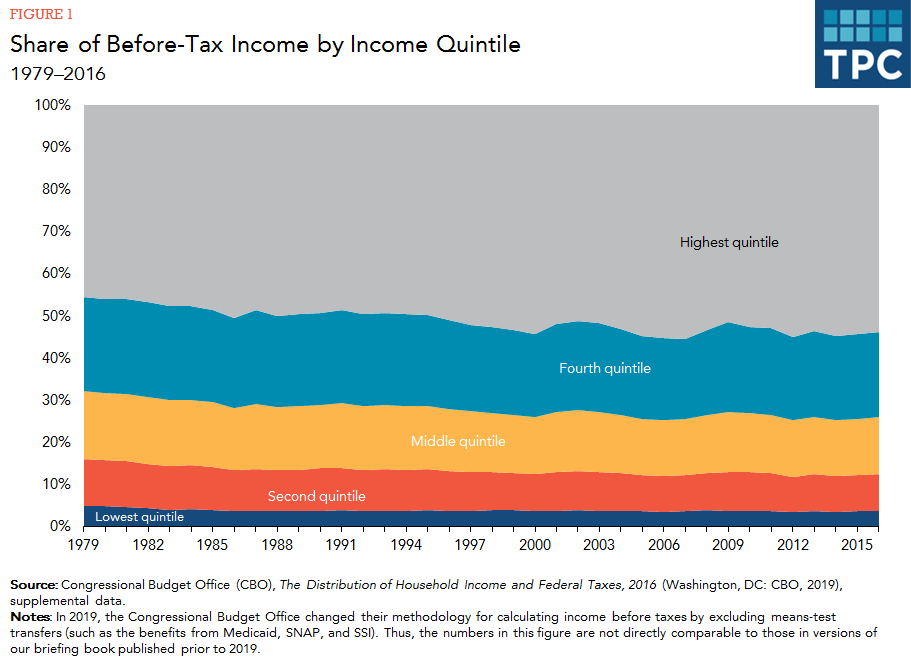

How Do Taxes Affect Income Inequality Tax Policy Center

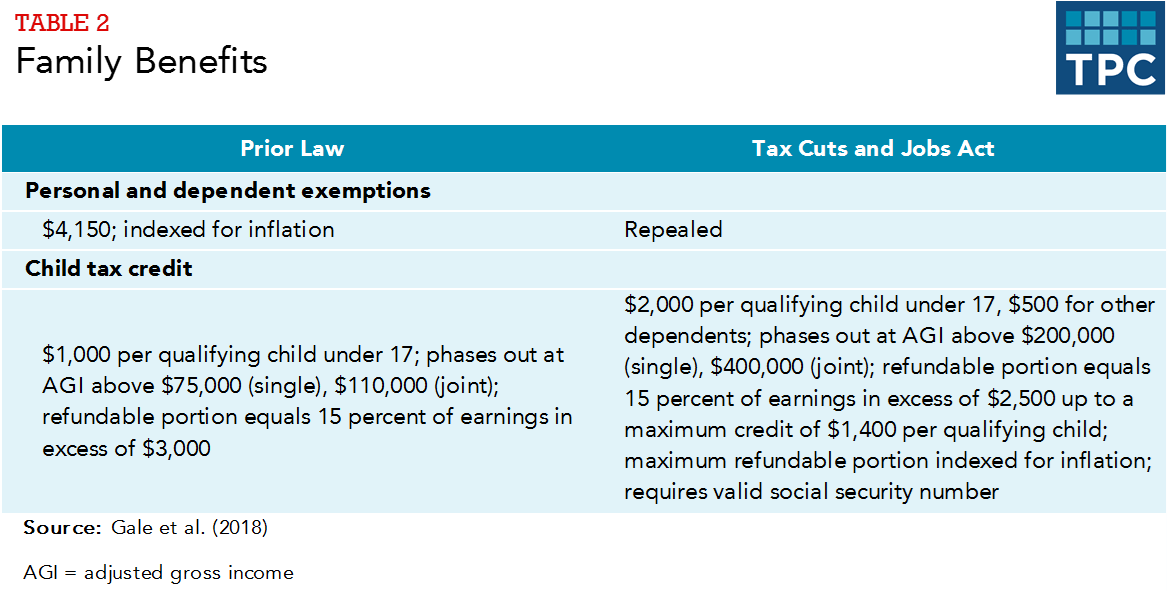

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Changes In 2021 Aca Reporting Health Insurance Coverage How To Plan Irs Forms

Features Of Comparative Statics Assignments Microeconomics Study Micro Economics

In 2011 Convey Sponsored A Tax And Regulatory Survey Carried Out By The Institute Of Financial Operations During A Time Of U Tax Infographic Accounts Payable

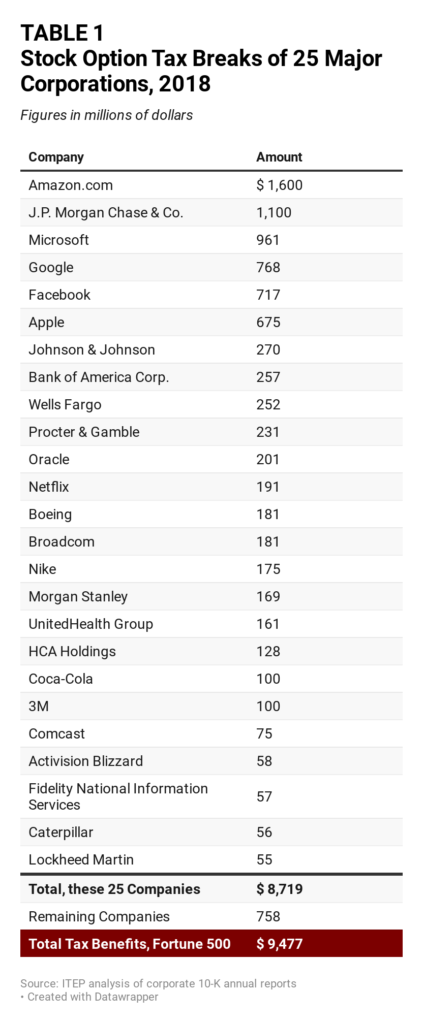

How Congress Can Stop Corporations From Using Stock Options To Dodge Taxes Itep

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

What Are The Consequences Of The New Us International Tax System Tax Policy Center

Proposed Tax Changes For High Income Individuals Ey Us

What Is E Way Bill Under Gst Goods And Services Internet Usage Goods And Service Tax

Calculating Taxable Social Security Benefits Not As Easy As 0 50 85 Moneytree Software

:strip_icc()/trump-s-tax-plan-how-it-affects-you-4113968-6d78115126514c15a71278d826a751ed.gif)

:max_bytes(150000):strip_icc()/balance-tax-return1-8b74d7fde2b44e5baa394d2ceda7d730.jpg)